The Federal Court has dealt Facebook a blow, ruling the social media giant operates in Australia – and legal action against it can go ahead

The New CTRS (Commercial Tenancy Relief Scheme) Regulations released by Victorian Government and are now up on the Vic legislation website at https://www.legislation.vic.gov.au/as-made/statutory-rules/commercial-tenancy-relief-scheme-regulations-2022

In brief:

On 16 January 2022 the extended CTRS took effect and will end on 15 March 2022.

Eligible businesses (tenants) that make a compliant rent relief request under the extended Scheme will be eligible for relief retrospectively from 16 January 2022.

The definition of SME changes to ‘small entity’, defined as an entity with turnover (including group) of less than $10 million.

Eligibility can be assessed by comparing turnover from January 2020 to turnover from January 2022 or if the business closed for a week or more during January 2020 because of an event or circumstances outside the tenant’s usual operations and started trading again by 31 January 2022, the tenant can compare December 2019 turnover with December 2021.

Alternative tests are available for different circumstances.

Minister Pulford has announced on Saturday that the Victorian Commercial Tenancy Relief Scheme (CTRS) which was to cease on 15 January 2022 will be extended until 15 March 2022.

There will be some changes to the scheme and its operation will be retrospective commencing Sunday 16 January 2022.

Small Business Victoria will work with stakeholders to develop the regulations to support this announcement as they did with the previous versions. It is expected that the new regulations will be in place in a couple of weeks.

Some key features of the extended scheme to note:

- The eligible turnover threshold has been reduced to $10M or less per annum

- It will be retrospective, commencing on 16 January 2022 and continuing until 15 March 2022

The policy intent of this is that for tenants who are entitled to and accessing rent relief under the current CTRS regulations, and who remain eligible under the new CTRS regulations, there will be no gap in coverage of the scheme between when the current regulations end and the new regulations are in place. The practical impact of this would be that their entitlement to rent relief continues unbroken and the eviction and rent increase prohibitions remain in place.

- We will continue to provide information and free dispute resolution to tenants and landlords

Once the regulations are developed the Victorian Small Business Commission will update the FAQs and supporting website content.

They have also commenced reviewing the existing website content to make amendments to the current language which refers to 15th of January as the end of the scheme.

As a holding measure, a banner has been placed on the VSBC website noting the announcement of the scheme’s extension for some current participants. They will work closely with SBV and stakeholders to develop the new FAQs and content.

- Landlords will not be able to lock out or evict tenants without undertaking mediation through the VSBC

- Eligible commercial landlords will continue to be eligible to access the Commercial Landlord Hardship Fund

This information has crossed our newsdesk today. The Australian Immunisation Register (AIR) form (IM017) for ceasing correspondence and release of information

Use this form to advise the Australian Immunisation Register you don't want to receive correspondence, or share information with third parties.

The question is whether this is even relevant to the issue they claim. If in fact the Government has an intention to have a Vaccine Passport for domestic purposes whether your records from the Australian Immunisation Register are shared with the States or other third parties would be quite irrelevant. What would be relevant is that you don't have the Vaccine Passport and without it you can not do X, Y or Z whatever prohibitions are potentially placed.

"The AVN has just discovered that there are plans to use the data from the Australian Immunisation Register (AIR) to inform State Governments of who is and is not vaccinated for the purposes of bringing in a vaccine passport within the next 2 months.

What we were not aware of is the fact that we can opt-out of allowing the government to share our data with any third party including sharing it with the States (it is currently held by the Federal Government) or whomever will win the tender to operate the passport system.

Time is short since the federal government has already said they have everything ready to go for the vaccine passports and are only waiting on the States to complete their end.

Please visit this website - https://www.servicesaustralia.gov.au/organisations/health-professionals/forms/im017 and fill in the form IM017. It cannot be submitted online but must be printed out and mailed - we recommend you do this by express post and also if you don’t mind spending a few dollars extra, paying for the proof of delivery so you have the signature of who has received it should they claim they never got it."

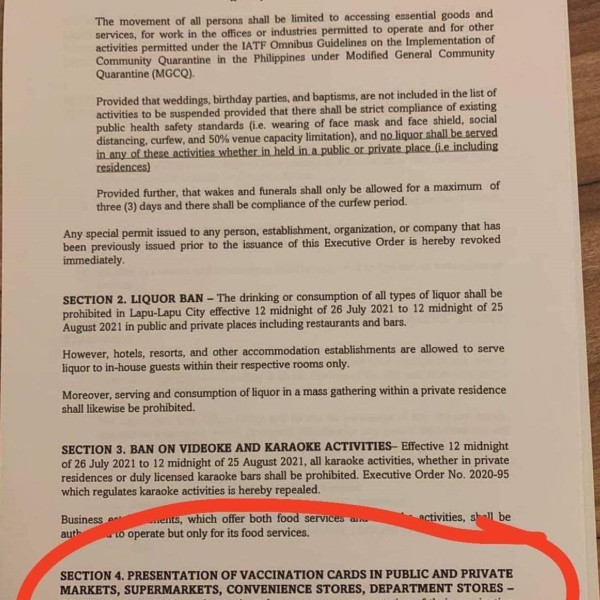

For instance you can see in the attached image in from the Philippines, the Government there is taking similar measures and if you can not present the vaccination card you are prohibited from entering public and private markets, supermarkets, department stores, grocery stores etc.

So in this case anyone who opted out from the Australian Immunisation Register sharing information with third parties would unlilkely achieve the outcomes that they seek, in that it would not thwart the implementation of a similar vaccine card or passport in Australia.

Full document here:

COMMERCIAL TENANCY RELIEF FOR VICTORIAN BUSINESSES

The Victorian Government is acting decisively to back the state‘s small and medium-sized businesses as they emerge

from lockdown, facilitating commercial rent waivers and deferrals from Wednesday, 28 July 2021.

The Australian Competition and Consumer Commission has suffered a humiliating defeat in the nation’s first cartel prosecution, with a Federal Court jury exonerating healthcare equipment maker Country Care and two executives.

The Supreme Court rejected an appeal from Johnson & Johnson seeking to undo a $2.1 billion damages award against it over allegations that asbestos in its talc powder products, including baby powder, caused women to develop ovarian cancer.

ATO loses JobKeeper test case in the Full Federal Court

A sole trader has been granted access to JobKeeper after the Full Federal Court unanimously ruled that the ATO had erred in its decision not to grant the business more time to establish its eligibility.

“As is made plain by government announcements and the provisions of the legislation, the JobKeeper payment was intended to benefit taxpayers in Mr Apted’s general circumstances,” said Honourable Justice Thomas Thawley.

“The commissioner, in his reasons, did not point to any good reason not to exercise the discretion in s 11(6) in Mr Apted’s favour; it is clear that the real reason for the commissioner’s refusal to exercise the discretion was the lack of ABN registration on 12 March 2020.

“But this was the very thing which lay the foundation for the exercise of the discretion. Of itself, this was not a proper basis to refuse to exercise the discretion.”

Honourable Justice John Logan also pointed out that the Australian Business Registrar — the Commissioner of Taxation in another guise — had accepted that Mr Apted was carrying on an enterprise before 12 March 2020, giving “pause for thought as to why Mr Apted has been put to so much bother in relation to his eligibility to receive a payment the object of which ‘is to provide financial support directly or indirectly to entities that are directly or indirectly affected by the coronavirus known as COVID-19’.”

“The broader application is that in every decision that the commissioner has made where he has refused to exercise a discretion, he now needs to go back and check it because the Full Federal Court has said you’ve taken a far too narrow approach in exercising the discretion and you need to look at the facts of the taxpayer,” Ms Williamson told Accountants Daily.

“A lot of state relief was based on the fact that you needed to be registered for JobKeeper, so there’s going to be flow-on issues if businesses can now get it.”